Tax Deductibility of Whole House Generators: A Financial Insight

Introduction

In a world where power outages can disrupt daily life and cause significant inconvenience, the installation of a whole house generator has become increasingly popular. Not only does it provide peace of mind during emergencies, but it also ensures that everyday activities continue uninterrupted. However, one question often comes to mind for homeowners considering this investment: Is the cost of a whole house generator tax-deductible? This article will explore the tax deductibility of whole house generators, offering financial insights and practical advice.

Understanding Whole House Generators

What is a Whole House Generator?

A whole house generator is an automatic backup system that provides electricity to your entire home during a power outage. Unlike portable generators, which typically power only essential appliances, whole house generators are designed to support all your household needs without interruption.

Benefits of Installing a Whole House Generator

The Role of Generator Installers in the Process

Finding Reliable Generator Installers Near You

When considering the installation of a whole house generator, finding reputable generator installers is essential. Look for local experts who can provide you with valuable insights into the best models for your home.

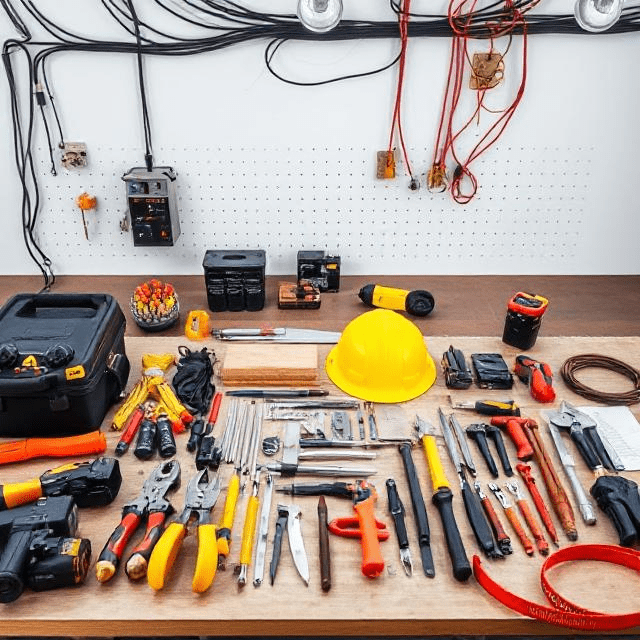

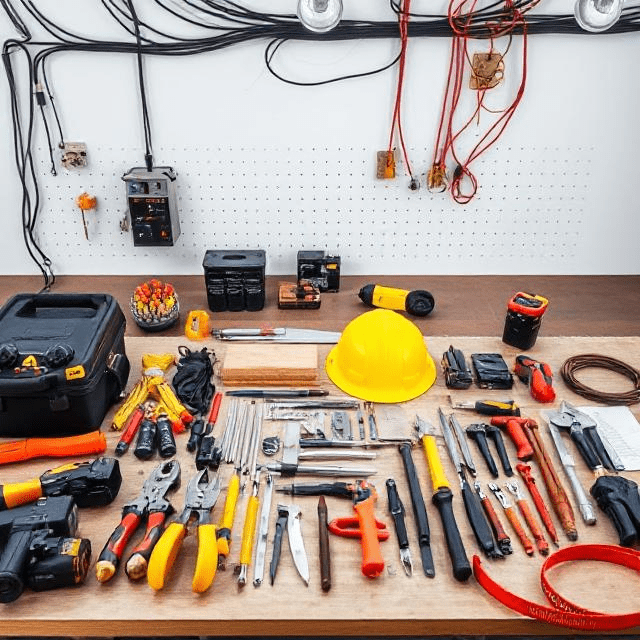

What to Expect from Generator Installation Services

Professional installation ensures that your generator is correctly connected to your home's electrical system. Experienced installers will:

- Assess your home’s energy requirements.

- Recommend suitable generator models.

- Provide ongoing maintenance tips.

Tax Deductibility of Whole House Generators: A Financial Insight

Understanding Tax Deductions in Home Improvements

Home improvements can sometimes qualify for tax deductions if they add value or adapt the home for medical needs. But how does this apply to whole house generators?

IRS Guidelines on Home Improvements

According to IRS guidelines, certain energy-efficient upgrades may be eligible for tax credits. While whole house generators may not fall under conventional home improvement deductions, they might qualify under specific circumstances.

Eligible Circumstances for Tax Deductions

Medical Necessity and Energy Efficiency Credits

If installing a generator is deemed medically necessary—such as for residents with health conditions relying on electric-powered medical devices—homeowners may find themselves eligible for certain deductions or credits.

Consulting with Tax Professionals

Importance of Seeking Professional Advice

Navigating tax deductibility can be tricky; consulting with a tax professional familiar with current laws can help clarify eligibility regarding home improvements like generators.

Cost-Benefit Analysis: Is It Worth It?

Initial Costs vs Long-Term Savings

While upfront costs for purchasing and installing a whole house generator can be significant, long-term savings through reduced damages from power outages can make it worthwhile.

Exploring Financing Options for Installation

Home Improvement Loans and Grants

Many homeowners consider financing their whole house generator through home improvement loans or grants available in their area.

Local Resources: Finding Installation Companies Nearby

When searching for "whole home generator installation near me," focus on local companies with strong reputations and positive reviews to ensure quality service.

FAQ Section

1. Are whole house generators tax-deductible?

Generally, they are not directly deductible unless categorized as necessary medical equipment or energy-efficient upgrades under specific programs.

2. What are common costs associated with installation?

Installation costs typically range from $5,000 to $15,000 depending on generator size and electrical work required.

3. How do I find reliable generator installers near me?

Look online using search phrases like "generator installers near me" or check local business directories for customer reviews.

4. Can I install my own whole house generator?

While DIY installations are possible, it's highly recommended to hire professional installer services for safety and compliance reasons.

5. What type of maintenance do these generators require?

Regular maintenance includes checking oil levels, battery checks, and testing the system monthly to ensure readiness during outages.

6. Are there any state-specific incentives for installing generators?

Many states offer incentives or rebates; checking with recommended whole house generator installations local energy agencies can provide insight into available programs in your area.

Conclusion

Investing in a whole house generator offers numerous advantages that extend beyond mere convenience during power outages; it enhances safety and adds value to properties while potentially providing tax benefits under certain conditions. Understanding the nuances related to tax deductibility requires careful consideration and professional advice—but ultimately leads homeowners towards making informed financial decisions regarding their investments in backup power solutions.

This article laid out comprehensive insights into the financial aspects surrounding the purchase and installation of whole house generators while addressing their potential tax implications directly related to homeowners' needs today. Whether you're looking up “whole home generator installers” or seeking guidance on “generator installation services,” being informed helps you make sound decisions that align both with your budgetary constraints and personal requirements effectively!